Chapter 7 Bankruptcy Protection

Chapter 7 Bankruptcy Protection

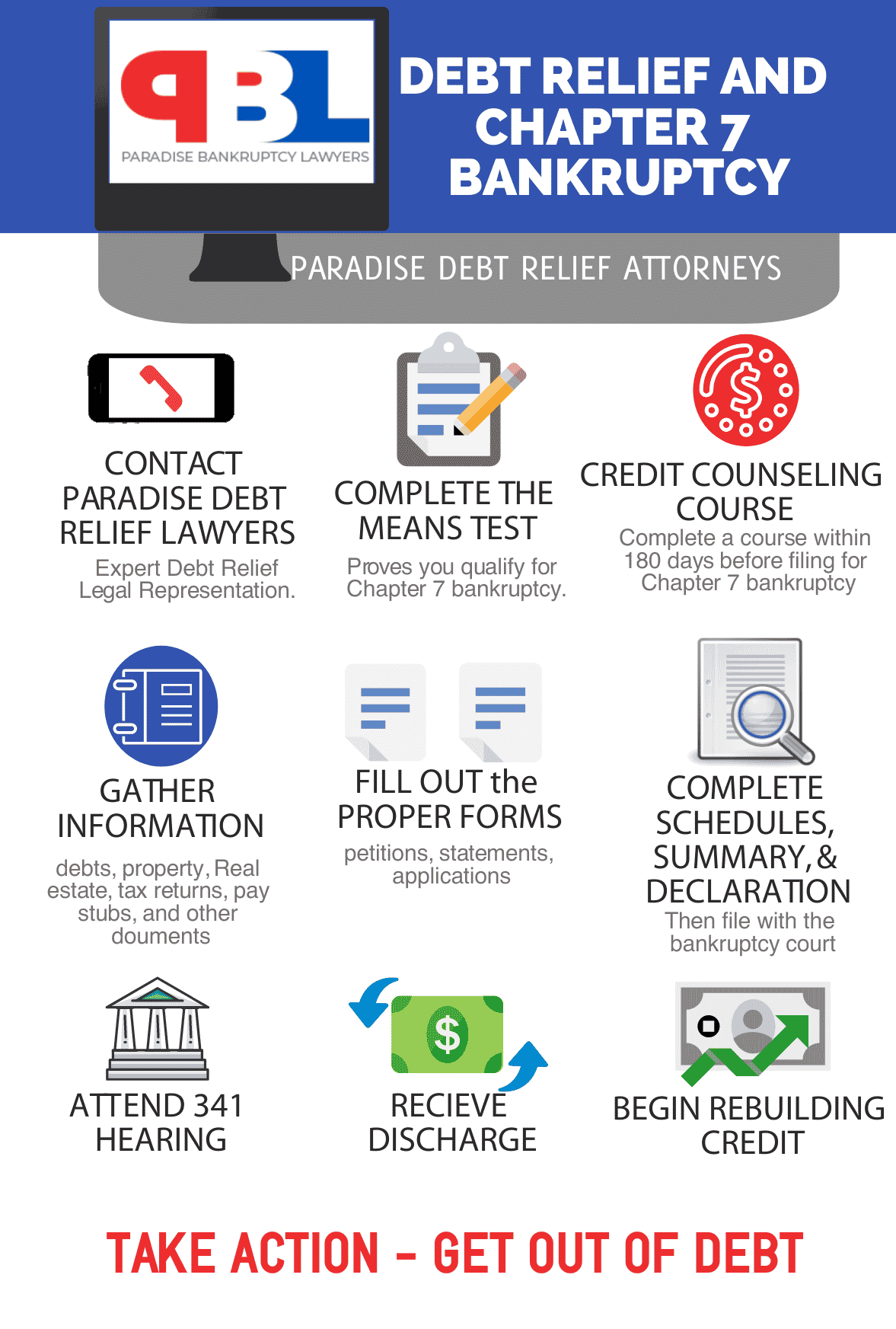

Paradise Debt Relief and Chapter 7 Bankruptcy Attorney.

A Chapter 7 bankruptcy allows a debtor (one who owes money) to file a petition asking to erase or discharge their debt. Also, Nevada bankruptcy law allows a debtor to keep some income and property (Nevada bankruptcy exemptions). In addition, the advantage of Chapter 7 is that it can erase certain debt. Although, some debt cannot be eliminated with bankruptcy: child support, certain tax debt, student loans, secured debt, and alimony.

Because of a protection called automatic stay, any wage garnishment must stop, upon filing of a Chapter 7 bankruptcy. Also, the bankruptcy ends foreclosure, vehicle repossession, and any collection activity by creditors.

Chapter 7 for Married Couples in Nevada

Should you be filing a joint bankruptcy petition? If a debtor is married, it does not require he/she to file a joint bankruptcy with their spouse. If the debtor is filing alone, it does require inclusion of the spouse’s income on some of the bankruptcy forms.

Filing Chapter 7 bankruptcy can go hand in hand with filing divorce. Sometimes it is best to file bankruptcy before filing divorce, whereas, other times it is more beneficial to file divorce and then bankruptcy. If you are considering separating from your partner or getting a divorce, please contact an experienced Nevada bankruptcy lawyer to get your questions answered regarding bankruptcy and divorce.

It is possible to file ch 7 bankruptcy without your spouse. However, it is not always in your best interest to do so. Make sure that you contact a bankruptcy lawyer if you are married and considering declaring bankruptcy. Chapter 7 bankruptcy for couples in Nevada can get somewhat tricky. We don’t recommend tackling it without the guidance of a debt relief expert.

In order to get the best desired outcome for your debt relief and if you are married and have a family, contact our attorney who can make sure that all your rights are protected. Specifically, an attorney at Paradise Debt Relief Law Office will listen to your needs and evaluate your debt situation to ensure that all proper legal measures are taken to achieve your financial goals.

Filing Ch 7 Bankruptcy in Paradise, Nevada

You must be eligible to file Chapter 7 in Paradise. Also, you must meet these requirements:

- You must pass the Nevada Means Test

- Also you may not file if you have received a Chapter 7 discharge in the last 8 years.

When preparing for a Chapter 7 bankruptcy filing with your attorney, you will need to provide information about your debt, property, and finances. Every case is different, and the rest of the information required to complete all necessary forms will depend on your particular situation.

The experienced debt relief team at Paradise Debt Relief Attorneys law firm will help you with preparation of all documents, and deadlines. We will communicate with you throughout the entire process so that you feel confident and prepared and comfortable with the experience.

When to consider Chapter 7 Bankruptcy

- You are give a clean financial slate as a Chapter 7 erases most debt

- filing will stop wage garnishment

- creditors must stop calling you and harassing you in attempt to collect money

- filing may allow you to save your home from foreclosure

- you may keep exempt property

- filing stops a vehicle repossession in most cases

- bankruptcy stops utility service shut-off

- it gets rid of credit card debt

- it erases medical debt

- you can take control of your debt – and end the stress brought on by debt

- a fresh, new financial beginning